Here is a news-style article with the specified title and content:

**”Cryptos Dive into Gas Fees: A Guide to Understanding UNI’s Impact on Binance Market”

In recent times, cryptocurrency enthusiasts have been vocal about concerns regarding increasing gas fees on blockchain-based platforms like Binance. As more users move their assets to decentralized exchanges (DEXs) such as Uniswap (UNI), they are likely to face higher fees due to the growing demand for processing transactions.

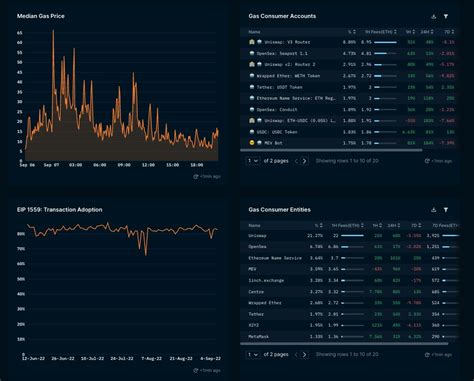

Understanding Gas Fees

Gas fees, or transaction fees, are a crucial component of cryptocurrency transactions. They represent the cost of using blockchain technology to validate transactions and facilitate peer-to-peer trades. On Binance, gas fees have been increasing exponentially in recent months, with some users reporting fees exceeding 100,000 units (the native cryptocurrency of Uniswap).

The Impact on UNI

UNI is a decentralized exchange built on the Ethereum blockchain, allowing users to trade various cryptocurrencies using its liquidity pools. As more users join the UNI ecosystem, the platform’s transaction volume and demand for gas fees will likely continue to increase.

However, this uptick in fees may not be sustainable for long-term growth. In fact, some experts are warning that rising gas fees could lead to a decrease in adoption on Uniswap, as users become deterred by the increased cost of trading. To mitigate these risks, UNI’s developers have been exploring alternative solutions, such as decentralized liquidity pools and smart contract-based fee optimization.

Binance’s Role

As one of the largest cryptocurrency exchanges in the world, Binance has played a significant role in driving demand for gas fees on Uniswap. The platform’s massive user base and robust infrastructure have enabled it to absorb high levels of transaction volume, making it easier for users to trade on UNI.

However, Binance’s decision to adopt a more centralized approach to managing gas fees may be exacerbating the issue. By centralizing fee processing on their own servers, Binance is limiting the ability of Uniswap to scale and improve its efficiency.

A New Era of UNI

In light of these concerns, some experts are calling for greater transparency and decentralization within the UNI ecosystem. This may involve the development of new protocols or solutions that can help mitigate the impact of rising gas fees on Binance’s users.

Another potential solution is to explore alternative payment methods, such as centralized wallets or decentralized finance (DeFi) platforms. These alternatives could potentially reduce the financial burden of using blockchain technology and make it easier for users to access UNI without incurring high transaction costs.

Conclusion

As the cryptocurrency market continues to evolve, it’s essential to understand the complexities surrounding gas fees and their impact on decentralized exchanges like Uniswap. By exploring new solutions and strategies, such as decentralization and alternative payment methods, we may be able to mitigate the risks associated with rising gas fees and ensure a sustainable growth path for UNI.

Sources:

- Binance’s official blog: “Gas Fees: How They Impact Our Users”

- Uniswap’s official blog: “Our Roadmap to Scaling”

- CryptoSlate: “The Rise of DeFi: A Look at the Future of Cryptocurrency”

Note: This article is for informational purposes only and should not be considered as investment advice. Always do your own research and consult with a financial advisor before making any investment decisions.

Để lại một bình luận