Title: Mastering the Art of Trading with Long Positions, Settingtle Risk, and Price Action

Introduction

Trading is a high-stakes game where emotions can run high, but discipline and strategy are essential for success. One common trading approach is to take a long position in an asset, hoping its price will rise over time. However, there’s a catch: market volatility can quickly turn this strategy into a nightmare of settlement risk. In this article, we’ll delve into the world of Long Positions, Settlement Risk, and Price Action, exploring how these concepts work together to shape your trading decisions.

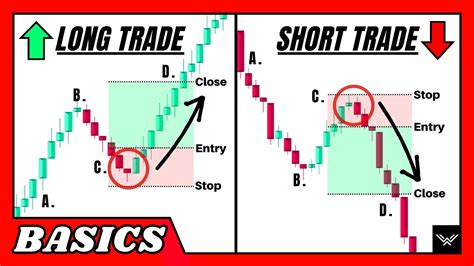

Long Position

A long position is when you buy an asset with the expectation that its price will rise over time. This strategy can be lucrative if executed correctly, but it’s not without risks. Here are a few key aspects of long positions:

- Buying Power: As the owner of the assets in your account, you have control over how much money is available to invest in each trade.

- Risk: Long positions carry a higher level of risk, as market downturns can quickly result in significant losses if the price falls or stays low for too long.

- Profit Potential: With a long position, you can capture gains once the price has reached your desired level.

Settlement Risk

When trading with an account that doesn’t offer settlement options (also known as non-custodial accounts), you need to worry about settlement risk. This is when the trade isn’t settled in time for you to receive payment from the seller before the market closes on the next business day. Settlement risk can be significant if not properly managed:

- Liquidity: Without settlement options, liquidity becomes a major concern; it’s difficult to close out positions quickly or get cash back.

- Time Decay: Time decay occurs when you’re unable to settle the trade before the market closes, resulting in lost time and potential losses.

Price Action

Price action refers to the dynamic interplay between buyers and sellers in the market. It involves observing how price trends shift over time, influenced by various factors such as supply and demand imbalances, technical analysis signals, and emotional reactions:

- Bullish and Bearish Tendencies: Price action helps identify trends, providing insights into potential future movements.

- Support and Resistance Levels: Understanding these levels can help you anticipate price shifts and limit potential losses.

Combining the Concepts

When trading with a long position, settlement risk, and price action all work together to create a complex decision-making process. To succeed:

- Develop a Long-Term Perspective: Understand that market fluctuations are inevitable.

- Stay Disciplined: Avoid impulsive decisions based on emotions rather than analysis.

- Monitor Price Action Closely: Keep an eye on price movements and adjust your strategy accordingly.

- Set Clear Goals and Risk Management Systems: Establish a well-thought-out risk management plan to mitigate losses.

In conclusion, trading with long positions, settlement risk, and price action requires a deep understanding of the markets, discipline, and patience. By mastering these concepts, you can navigate the complex world of trading with confidence and success.

Để lại một bình luận